How will Pent-Up Demand and Vaccines Affect Buying Behavior?

Five brand categories are expected to benefit from new consumer behaviors and pent up demand beyond 2021, and economists are optimistic the COVID-19 vaccine will boost consumer confidence and sales. People’s lifestyles, values and buying behavior shifted dramatically during the pandemic, and according to research by Global WebIndex, most people resolved to save more money this year, and focus on wellness, self care and spending more time with family and friends.

Pent up demand, and new consumer priorities are expected to benefit five brand categories beyond 2021:

- Home Improvement: Extra time at home during the pandemic inspired a do-it-yourself movement

- Banking & Fin-tech: Consumers want contactless payments and digital money management tools

- Petcare: Americans of all ages are spending more time (and money) pampering pets to feel better

- Travel: Pent up wanderlust and savings are motivating travelers to book bucket list trips in advance

- CPG: Safety, convenience and personalization are motivating consumers of all ages to buy online

Home Improvement: Extra time at home during the pandemic inspired a do-it-yourself movement

Now that we do just about everything from home — and mortgage rates hit 11 year lows — suburban home sales and renovations are leading the U.S. economic recovery according to MarketWatch.

People want more space to spread out and entertain outdoors, and are creating dedicated rooms to work, learn and exercise at home. And all the extra time at home during the pandemic inspired a do-it-yourself movement — especially among younger homeowners. According to the Joint Centers for Housing Studies of Harvard University, home owners under the age of 35 spend more time and money on DIY maintenance and home improvement projects than any other age group.

Homeowners usually do hire professionals for major renovations according to the Home Improvement Research Institute, and wellness and hygiene features are trending, such as circadian lighting, touchless faucets, air purification systems and water filtration systems to reduce the amount of packaging they throw away.

4 out of 5 homeowners are planning ‘do it yourself’ home improvement and maintenance projects, and trust online sources and staff at home improvement stores for ‘DIY how to’ advice and product tips.

Sources: Home Improvement Research Institute, Joint Centers for Housing Studies of Harvard University, MarketWatch, Shelton Group, U.S. Census Bureau and U.S. Department of Housing and Urban Development,

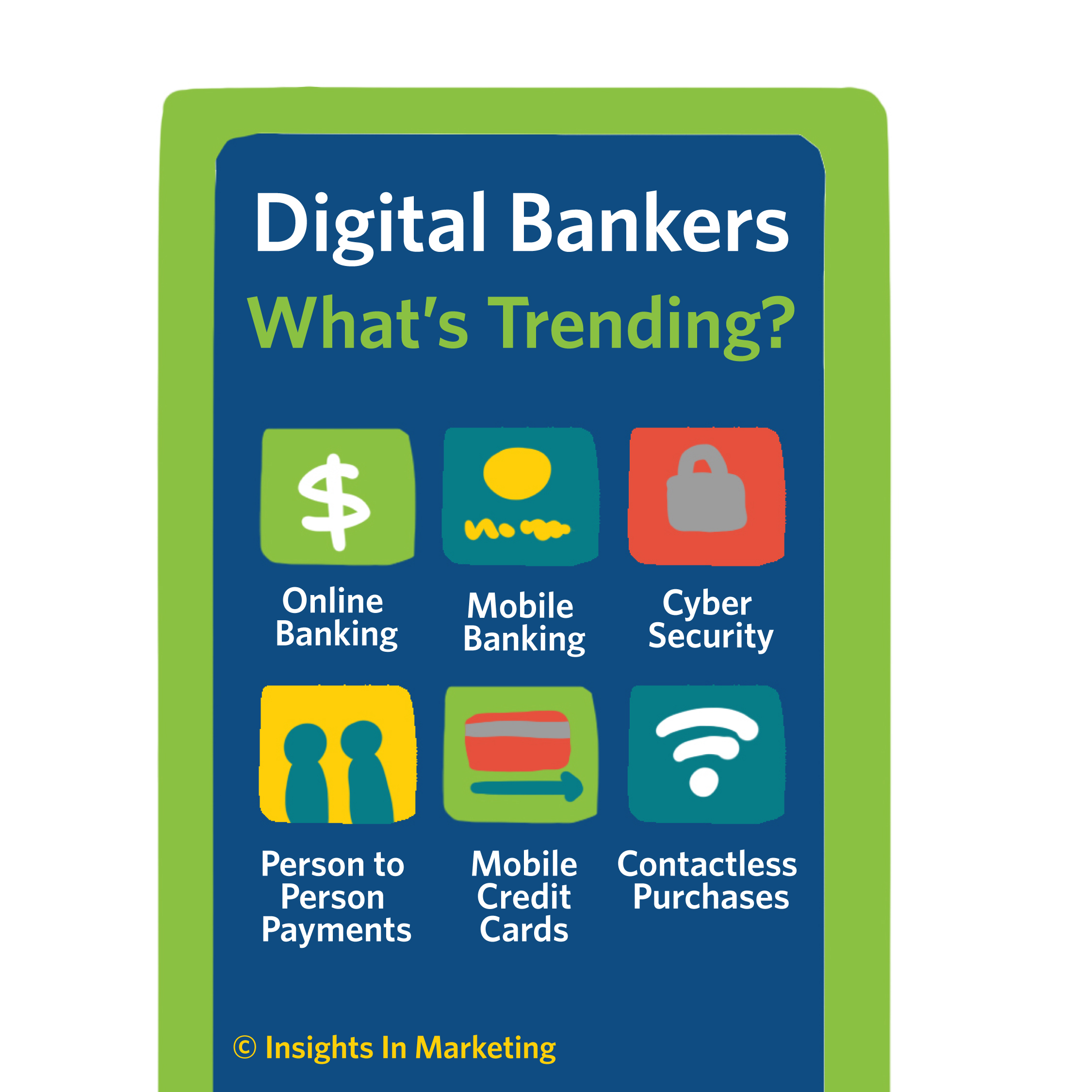

Banking & Fin-tech: Consumers want contactless payments and digital money management tools

Americans stashed an extra $1.4 trillion into their savings accounts in 2020 according to a Moody’s Analytics report published by the and Los Angeles Times, and over 53% of American’s made a resolution to continue to save more money in 2021 according to Global WebIndex.

Nearly all younger consumers prefer to use mobile apps to manage their money, and over 70% of younger consumers are seeking digital tools and information to learn how to invest and save for future purchases.

Most consumers prefer mobile or online banking tools to manage their finances according to a recent Business Insider Intelligence report. However over half of consumers do go to a physical bank to deposit checks, and about 40% of consumers feel safer going to a bank to deposit or withdraw cash.

3 out of 4 consumers count on their banks for tips and digital tools to manage their money, and demand is growing for mobile apps to make contactless purchases in stores and transfer money to other people

Sources: Business Insider Intelligence, Banking Industry Overview, State of Mobile Banking, Trending Digital Payment Methods, Statista

Pet Food & Treats: Americans of all ages are spending more time (and money) pampering pets

Pampering pets has comforted people during the pandemic, and American pet owners set a record in 2020, spending close to $100 billion on pet products according to the American Pet Products Association.

Pet lovers of all ages shop online and in stores. Most consumers buy food targeting their pet’s dietary needs, and 69% of consumers under the age of 35 feed their pets natural or organic food and treats. Over half of consumers treat their pets as family members and celebrate holidays and birthdays with special treats.

Trending pet products include natural and organic pet food ingredients, sustainable products and packaging, holistic supplements, CBD-infused products for cats and dogs and there is growing interest in smart pet technology, like GPS collars, pet cameras, and feeders.

2 out of 3 American households have pets, and an increase in pet adoptions during the pandemic is expected to increase spending on pet care products and services by an average of 3-6% per year.

Sources: Statista, American Pet Products Association, Petfood Industry Trends Report, SPINS Pet Trends, U.S. Pet Market Outlook

Travel: Wanderlust is motivating travelers to book bucket list trips years in advance

Travelers have pent up wanderlust, and extra savings from trips put on hold during the pandemic. Advance bookings for bucket-list trips are up by as much as 160% compared to before the pandemic according to a recent New York Times report. In fact, over half of luxury travelers took a domestic trip during the pandemic, and 63% say they intend to advance book an international trip during 2022, or later, according to Travel Pulse,

After experiencing the pandemic, consumers are seeking more remote designations, and experiences focused on self improvement and wellness. Concerns about cancellations, crowds, health and safety protocols and travel restrictions are expected to linger through 2023.

According to a recent report by the Forbes San Francisco Business Council, travelers under the age of 35 spend more of their discretionary income on travel experiences than any other age group, and plan trips based on blogs by local experts and online reviews. The fastest growing segment of luxury travelers is the over 50 age group. This demographic discovers destinations through email, TV ads and travel magazines. Also, more women are traveling solo, and rely on word of mouth recommendations to discover women-only wellness retreats and tours with luxury brands.

2 out of 3 luxury travelers are booking vacations to ‘long haul’ destinations years in advance, and want more flexible cancellation policies.

Sources: McKinsey, Strategic Vision, Travel Pulse, Forbes San Francisco Business Council

Consumer Packaged Goods: Safety, Convenience and personalization are motivating older consumers to buy online

Online CPG sales boomed during the pandemic due to safety concerns and product availability in stores, and consumers have discovered they like the convenience and personalized products available online according to market research by Kantar.

CPG sales are expected to grow an additional 10% this year and the fastest growing segment of online shoppers is consumers over the age of 50. There are distinct generational differences in the way consumers discover and buy CPG brands. While most younger consumers use mobile phones, most online shoppers over the age of 50 use computers, and discover products they want to buy through TV ads, online searches, email and social media.

9 out of 10 consumers say they will continue shopping online for CPG brands after the pandemic because it’s convenient, and they like personalized products. The fastest growing segment is consumers over age 50 using computers to shop.

Sources: Chain Store Age, Interactive Advertising Bureau, Kantar, Statista

Interested in learning more?

Follow our consumer insights blog series to learn how lifestyle changes, demographic shifts and buying behavior are expected to drive growth and innovation, and learn more here:

- Understanding the Consumer Journey Optimizes Customer Experiences

- Five Ways Brands Win Consumer Sentiment

- Is Social Media the New Storefront?

- Food & Beverage Insights: 5 Consumer Behaviors Inspiring Brand Innovation

Insights In Marketing is a marketing research firm that delivers in-depth and actionable insights so you can have every confidence your decisions are inspired by the consumer voice. Our team has decades of client and supplier side research experience, and our marketing expertise spans across various industries and consumer segments.

Looking to create a genuine connection with your customers?

Share this article:

Related Resources

CPG in 2025: The Flavorful, Functional & Fan-Driven Future of Consumer Goods

The Consumer Packaged Goods (CPG) industry is undergoing a massive transformation, shaped by evolving consumer…

From Idea to Icon: The Life Cycle of a Super Bowl Ad

From Idea to Icon: The Life Cycle of a Super Bowl AdA…

Seizing Business Opportunities in the GLP Era

While GLP medications disrupt traditional health and wellness models, they also present unique opportunities for…

The Generational Shifts in Health and Wellness: What It Means for Businesses

As consumers increasingly prioritize health and wellness, generational preferences and behaviors are driving a…